Written by: Alex and Nivhya

Edited by: Wu Wen Qi

“The Economics of COVID-19” was an event hosted by Sunway Economics Society with an honorable speaker, Professor Eduard J. Bomhoff. This event provided the fellow participants insights on how COVID-19 has impacted the economy in the South East Asian Region and Western relations. In addition, Professor Eduard himself shared his forecasts about the future of the economy in said areas. For a better insight into the economics of this current pandemic, the event was divided into different sections. These are the key things to take note of based on his slides and followed by his answers from the Q&A session.

1. COVID-19 Death Rates Are Negatively Correlated with Temperature

COVID-19 tends to react poorly in tropical countries. The general trend is that the number of cases decreases across the northern hemisphere based on their monthly temperature. On the other hand, cases have increased in Brazil and Columbia when the temperature was considerably lower than its normal temperature. Damaging psychological factors such as the uncertainty about the future causes people to wonder about the future conditions of the global economy based on their assumptions on the state of the pandemic and how long it will take for the global economy to fully recover from this pandemic. Hence, consumers tend to be more cautious of their daily cash flow. This increases their savings and reduces spending, resulting in a difficulty to make predictions due to the uncertainties.

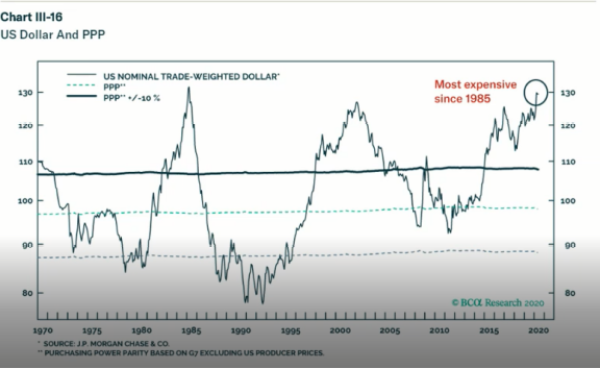

2. US Dollars(USD) and Purchasing Power Parity(PPP)

In 2020, demand for USD has skyrocketed and has become the most expensive since 1985. International investors prefer the USD as the US is a strong country and has a well-established Central Bank. Based on the forecast, the US keeps the interstate travel at 0 until the year 2022 while China and Europe have higher interstate travel. Since China’s product has become more competitive, US citizens have increased their demand for China goods hence their demand for RMB has increased causing RMB to appreciate, meanwhile US supplies more of their currency which causes USD to depreciate. Another prediction, quoted by Professor Eduard whereby “USD will be weaker, unless there is a second wave of COVID-19 with a stronger virus. Then, people will flee into buying USD again as they tend to do in uncertain times.”

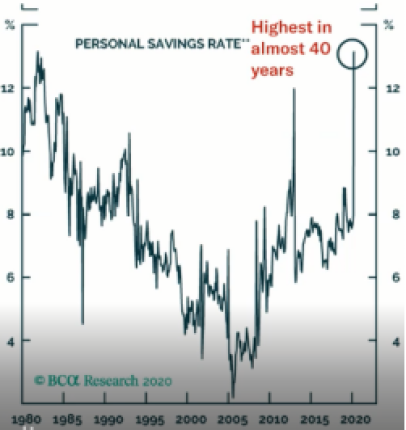

3. Personal Saving Rate

Being the highest in almost 40 years, the last peak for the Personal Saving Rate was in 1982/1983 during the early 1980’s recession. During these tough times, the unemployment rate increased. People began to start saving not because the banks provided attractive interest, but rather they are being more careful and are taking precautions. As the economy recovers, consumers’ spending will increase gradually. In this case where the Personal Saving Rate is at its peak, the economy will not be able to recover if this rate remains. Companies will only regain their confidence in continuing to operate their business once the rate decreases. Clearly, the demand side is dependent on the saving rate rather than the supply side, which depends on uncertainty such as the possibility of a second wave and how it will affect the third quarter (Q3) and the fourth quarter (Q4) of this year.

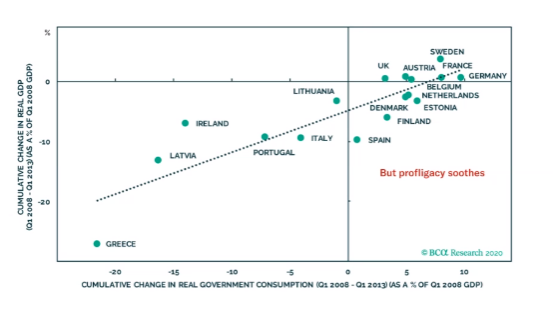

The x-axis shows the amount of government consumption that is government spending on transfers and owners’ spending over the 2008/09’s recession while the y-axis shows the cumulative change in real GDP since 2008. For example, Greece went bankrupt and had to reduce government spending in order to pay its creditors and unemployment rates in Greece remained high after a few years. On the other hand, we have countries such as the Netherlands, Belgium, France, Austria, Germany, UK, all these countries were in a position where they could increase government spending because they could borrow and print money. Hence, their economy can be recovered quickly. In 2013, the economies improved significantly as compared before the crisis. Thus, ample government spending certainly helps economic development. Besides, politicians are allowed to increase government spending to ensure the election runs on a healthy economy and increase their chances of being re-elected. As Malaysia, Thailand and Singapore have low outstanding sources of government debt, the government has to spend more and hope for some returns and for people in the lower class to spend more, to achieve effective fiscal policy. Only then can the economy recover sooner.

5. Social Immobility vs Income Inequality

The x-axis shows the income inequality (movement in personal circumstances in relation to those of their parents, measured by 5 determinants – health, education, technology access, working opportunities, working conditions and fair wages and social protection and inclusive institutions). The y-axis shows the social immobility (Gini Index is used as an indicator). Countries with high Gini Index such as Brazil, Peru, Argentina, Chile, China, US and Italy have extreme rates of income inequality which favors most of the rich people. A good example would be a doctor who prioritizes treating his/her patients based on their wealth rather than the emergency of the case. Thus, there is a positive correlation between social immobility and income inequality. Utilizing rich people’s wealth to assist the poor is never the solution as the number of poor has far exceeded the rich. Instead, the government should focus on equality education and access to healthcare to all the people. Malaysia is better than the US when it comes to providing these basic facilities to its citizens, which contributes to political stability, especially when the poor are able to see the political party knowing its priorities in putting the citizens first.

6. Globalization

From the graph above, global exports as % of GDP dropped and is caused by the increased tariffs in the US and its outsourcing. Previously, the US would outsource their products from China but due to the tension created, they have been seeking alternatives from other countries. For example, Apple computers are now increasing their capacity to produce in Brazil, and they are going to outsource in Asian countries like Vietnam, Indonesia, etc which creates even more tension between the US and China. However, outsourcing from other countries might be beneficial as they will diversify their sourcing and this could be beneficial for Vietnam, Malaysia, Thailand and Indonesia. Moreover, China is viewed as less reliable in the area of intellectual property and is famous for stealing pay patents and not being a reliable partner according to World Trade rules. Hence, this reduces the confidence for international investors to invest in China which decreases globalization. Thus, less globalization is destroying the global economy.

After that, it was time for the Q&A session. Below are the questions asked and answered:

Question 1: Is it true that Australia to a certain extent escaped the 2008/2009 recession because of their generous stimulus package such as the direct transfer payment to its citizens?

The special thing about Australia and Canada is their flexible exchange rates which can appreciate or depreciate. For example, as the demand for the AUD increased, the export prices increased as well, which would have resulted in a lower demand for exports. However, due to the fact that AUD is flexible, Australia was able to increase their exports by lowering costs while benefiting from cheaper import prices. Hence they weren’t as affected as other countries when the financial crisis happened. Australia which is more oriented to China for its exports than other western European countries suffered less but still suffered. Due to the fact that AUD(Australian dollars) is a flexible currency, they allow the depreciation of the AUD and earn bigger profits through tourism and education. The western European countries tried to stimulate their economy, but the Euro currency was much more fixed than the AUD.

The banking sectors have also helped Australia and Canada acquire a small number of large banks. These large banks then assisted the commercial banks in providing funds to the eligible citizens. But the reserve bank made it very clear that they were not going to allow any bank merges. However, in western Europe and the US, before the crisis, there were a lot of bank mergers and these banks all tried to grow as quickly as they could because if they merge then it is to take over the smaller banks. Hence, the second reason why Australia managed to survive the financial crisis is that their commercial banks did not have risky behaviour nor did they borrow additional funds in the money market to expand their companies.

In short, sensible banking and currency policy.

Question 2: Since January, billions of major stock exchanges have been affected so do you think this is because of the market overreacting to COVID-19 or this might be the result of problems being built up over the years?

The New York Stock Exchange (NYSE) and worldwide stocks have recovered, and the average economic ratio is back again. The stock market clearly assumes there will be a single wave for this virus. Based on the 11th of June stock report, stock holdings fell at about 6% because there were news reports reporting on a second wave in parts of the US. So, Professor Eduard thinks the biggest concern for the stock market is if there is going to be a single wave of the virus or if there is going to be another wave in the future.

Question 3: Are stock market booms and busts correlated with economic growth and downturns?

It seems as if there has been a decoupling in recent years that has been exacerbated by COVID-19. The market probably assumes a single peak in the deaths.

Question 4: Given the rising popularity of Eurosceptic (or anti-globalisation) politics around the world and in Europe, what would you see for the future of free trade around the world, and what would you see in the future for the EU (i.e. will members leave, will members leave the Eurozone, etc)?

De-globalization seems likely as it is more critical now of China playing according to the rules. Greece did not leave the EU and it is risk-management on the part of the Greek politicians: if the people suffer they can blame Germany and Brussels but if they give up on the euro and that proves to be a disaster they will get the blame. Similar to their risk-management with COVID-19, If the government is too strict, although people suffer but they will blame the virus. However, if the government restores international travel and many people fall ill and die, then they will blame the government instead.

Question 5: Is it possible to completely recover from the economic damage the virus outbreak has caused? If so, is there a chance that countries will adapt to new methods of running their respective economies?

Yes, but it’s different. There will be more autarky in medical equipment. Professor Eduard hopes that they will also prepare for all the bad things: another pandemic, global warming, a meteorite hitting the planet and terrorists planting a dirty bomb in a financial centre. People have been focused so much on global warming that they have neglected these other three big risks.

Question 6: How long do you think it will take for the economy to recover from the damage done by the virus?

The US economic department predicted that the economy would need as long as 10 years to recover. With vaccines or antibodies found in early 2021, that should already take a good year of recovery. In addition, Malaysia (and Vietnam) will benefit from the issues with Chinese suppliers dealing with medical supplies.

The whole two-hour session has truly opened up every individual’s perspectives towards the current economic situation and urged not only themselves but others in coming hand in hand to help recover the economy in order to ensure that poverty is not on the rise.