Written by: Wu Wen Qi and Supriya Sivabalan

Edited by: Amal Hamizah

On 24th August 2019, Sunway Actuarial & Finance Excellence (SAFE) organized their first-ever ASymposium with the theme of pioneering actuarial revolutions. With the generous sponsorship of Great Eastern, Institute of Faculty of Actuaries (iFOA), Student Life, Sunway TES and many more, SAFE had the privilege to invite prestigious speakers and host an interesting actuarial conference which comprised of plenary talks and panel sessions, as well as a case study competition. The major goal of this event was to enlighten the participants on the impact of technological advancements on the actuarial field, study their importance and participate in this paradigm shift to stay ahead. At 8am sharp, there was already a crowd of alluring participants, all dressed in black and white suits and blazers queuing in line for registration in front of JC 1 hall.

At 9am, everyone was seated accordingly, awaiting the arrival of the VIPs. After five minutes, the guests of honour arrived and were welcomed grandly by the participants. To start off, Professor Ho Chee Kit, dean of the school of mathematical sciences in Sunway University was invited on stage to give a welcoming speech where he shared with us an anecdote which highlights the roles of the actuary. From his anecdote, he hopes that the audience is able to grasp the fact that we are living in a world of uncertainty where there’s a need to expect the unexpected, which is why we have to keep up with the advancement of technology in order to adapt to the new changes.

Following Prof. Ho’s speech, Dr. Elizabeth Lee Fuh Yen (Chief Executive Officer of the Sunway Education Group) then went up the stage to give her opening speech. She began her speech by stating her admiration towards Sunway’s actuarial students with their classy calculator. She also expressed her gratitude towards the respected speakers for taking their time to come to Sunway on a weekend. She motivated the audience to pursue their dreams in the actuarial field with a quote, “Don’t let success and money rule your life. If you make meaning, you’ll make money. If you make money, you might not make meaning”. With that being said, she hopes the audience could change the world for the better with their knowledge and be more concerned about the community, the country as well as the state of the world to provide a positive impact on the world.

After that, both Prof Ho and Dr. Elizabeth were awarded a token of appreciation and a group photo was taken to commemorate their efforts in providing many opportunities for the actuarial students in Sunway.

At 9.30 am, the first keynote session began with an informative presentation by Miss Sophia Ch’ng (president of the Actuarial Society of Malaysia) on the landscape of actuarial work. From her talk, she starts off by acknowledging the fact that it’s not easy to be an actuary due to the harsh competition. She then proved her point by sharing with us her tough journey from being a treasury consultant to Sunway’s consulting actuary which lead to her argument that there’s only 25% of students who successfully become actuaries in an actuarial department, but that’s completely fine. There are still many job opportunities for the other 75%. From this, she showed the audience numerous companies which provide jobs to actuarial students in the insurance, consultancy, data science and product marketing field.

There are three types of insurance: shared insurance, general insurance and life insurance. All that these firms look for in a job applicant is obviously their academic results, professional exams, practical experience and most importantly their life long skills. Companies may also consider people skills ( skills, independence, ability to work under pressure, etc.), IT skills (in Excel, UBA, SQL etc.) and industry or product knowledge. Miss Sophia also highlighted the responsibilities of actuaries; ethics and trustworthiness.

Due to time limitations, the talk ended and it was time for the Q&A session where the audience could ask burning questions through the padlet app. One of the questions asked was what made Miss Sophia so passionate about her job. She answered with her joy in contributing to society and she believes that passion and joy are key to be satisfied with what she’s doing. She also encouraged the audience to be resilient and preserving in their journey.

Subsequently, the panel session began with Dr. Ir. Mohamad Fahrurrazi (data scientist of the Centre of Applied Data Science) as the moderator of the forum where he asked the panellists questions. The panellists include Mr. Michael Yap Heck Wei (credit risk and model management in Maybank), Mr. Alvin Choong Ching Yek (appointed actuary in RHB Insurance Bhd) and Mr. Daniel Nee Yong Hong (chief actuary in AmGeneral Insurance Bhd). To commence the forum, the moderator asked the panellists a question on how predictive analysis affect the actuarial field. In short, they explained that predictive analysis has changed the way actuarial work. Besides that, the world is moving from descriptive analysis to predictive analysis where models are built using SAS to have a better prediction of data to run business.

Later, Mr. Mohamad asked the panellists what were the challenges they faced when handling their projects. Mr. Daniel shared with the audience his struggles which were convincing the state holders, CEOs and the marketing team with data. He believes that communication is the key. Once he honed his communication skills, he was able to overcome all of his issues. This is important in preventing garbage in garbage out (GIGO) to ensure that data will be used appropriately.

From Mr Alvin’s explanation, Mr. Michael also stated that from his experience, he believes that there’s a struggle to find the best fit model as no model is perfect nor ideal, models are only estimates. From that, it is important to use a machinery model than the traditional model, which requires a clear understanding of the input and the understanding of the philosophy behind it.

Lastly, Mr. Mohamad asked the panelists for any suggestions on any external resources to improve the student’s actuarial skills. Their suggestions included Kaggle which was an online community for data scientists and machine learners as well as Data Camp which helps individual learners to answer their most challenging questions by making better use of data. The audience was also encouraged to participate in Hekaton Projects to broaden their knowledge on data analysis. That concludes the panel session and the speakers were ready for the Q&A session. With the end of the panel session, the audience was ushered to Lunch Box to have their lunch. The participants of the case study competition were in a separate venue as the case study competition commenced after lunch.

After a hearty buffet-style meal at Lunch Box and printing tons of photos at the photo booth stationed in front of JC1, all participants eagerly awaited the second session of ASymposium. The second half of the symposium kicked-off with a plenary talk on Telematics under the theme Cutting-Edge Technologies in Actuarial Industry by Mr. Ong Shze Yeong from AXA. Mr. Ong began his talk by posing a question to the audience – “Do you think the insurance industry has room for innovation” to which the room replied with murmurs of “No’s”. He then began to strongly justify his personal belief that the insurance industry certainly has a long way to go in terms of innovation, which is where Telematics comes into play.

He enlightened the audience on the definition of telematics in layman terms – explaining that it is basically advanced technology that has already been in the market for a few years now. He then tied in telematics with Actuarial Science, on how such technology can help improve the collection of information for more accurate, personalised pricing and juxtapositioning its benefits with how inaccurate general pricing methods can be. Mr. Ong did this by performing a simple survey across the crowd and filtered out a student who was from Penang and a young male driver. “So, would you agree if I make the claim that you’re a bad driver, hence you have to pay a higher premium?”, he asked the chosen student. “No!” the student replied indignantly, followed by a roar of laughter from the room because of the typical “Penangites are bad drivers” stereotype. Thus, he proves his point on the downfall of current pricing models. Mr.Ong ended his speech by encouraging students to join the AXA Young Leaders Programme.

Up next is Mr.Nicholas Yeo with his plenary talk on IBNR Robot: Actuarial Application of Artificial Intelligence (AI) & Process Automation. Mr.Nicholas gave everyone a practical insight into the world of artificial intelligence and how to integrate the use of AI with what an actuary does. He stressed that the ultimate endgame for humans when it comes to technology is to achieve technological singularity, reaching the point of superintelligence that would surpass all human intelligence. As scary of a thought as it sounds, Mr. Nicholas reassured the crowd that he strongly believes in working with this advancement. Despite there being many challenges including scepticism, the issue of inertia where humans are unable to adapt and the steep learning curve, he listed many benefits that seem to outweigh these obstacles. These benefits include consistency, independence and instantaneous when it comes to actuarial work. With a Q&A session through the padlet app, Mr.Nicholas’s informative speech ended with great applause from the participants.

After a token of appreciation was handed out to the two featured speakers, a 10-minute break commenced, followed by the second panel session moderated by Sunway University’s very own Head of the Department of Actuarial Science and Risk, School of Mathematical Science. The panelists included 3 distinguished female figures as speakers namely Ms. Esther Lee Lin Tze – senior manager of Allianz, Ms. Dalila Hashim – Head of Actuarial Services and Ms. Caryn Chua – South-East Asia Representative of the Institute and Faculty of Actuaries (IFOA).

The panel tackled practical and important topics for all the eager students in the room revolving around issues of career prospects, employability and the generation gap for actuarial students. When posed with the first question, “What are the future aspects of actuarial science?” all three panellists answered enthusiastically, motivating students to keep their prospects wide and mind open to look toward non-traditional actuarial industries when venturing into the working world. In terms of the generation gap, Ms Dalila gave insightful experience in dealing with fresh graduates and their tendencies in using abbreviations and lack of email formats when it comes to the workplace. She stated that it is important for both generations to essentially meet in the middle and work towards adapting with one another. Ms Esther added that speaking out your opinions and thoughts in the workplace is crucial. Though it may seem daunting, this trait will set you apart from other candidates from the job! “Don’t be afraid to speak out”, she says, “you will definitely not always be right- but you learn when you’re wrong!” It was a very powerful and passionate panel talk with all goal-driven ladies sharing their experiences in the corporate world. Definitely one of the main highlights of ASymposium!

The final keynote session was presented by the vivacious, bubbly Mr Tan Suee Chieh – president-elect of IFOA. He started off his speech by making everyone “do something out of [their] comfort zone” by asking all participants to squeeze to the front of the hall where the VIPs were seated.

Many were initially reluctant but eventually, everyone obliged to this odd request and it certainly broke the ice of the serious and intense environment. Mr. Tan’s talk was very engaging with his interesting anecdotes and personal life stories. His speech revolved around the theme of “actuaries in new paradigms” where he spoke about “springboarding the future” i.e. preparing the potential actuaries for a sustainable career in the actuarial world rather than just surface-level skillsets that will get them the job, but not allow them to thrive in it. He considers the insurance industry as a “safe and secure box” and the meta need to break into this “box” is drive! He believes that with drive – all other skills including communication, resourcefulness, networking, etc. are secondary and can be trained. Mr. Tan left off by highlighting the new skill-sets the industry is looking into and certainly provided a fresh perspective for all attendees!

Thus, marks the end of the long-awaited actuarial event of the year! As the participants of the case study competition filled the hall once again, tokens of appreciation were handed out to everyone who was invited as a speaker, panellist and judge.

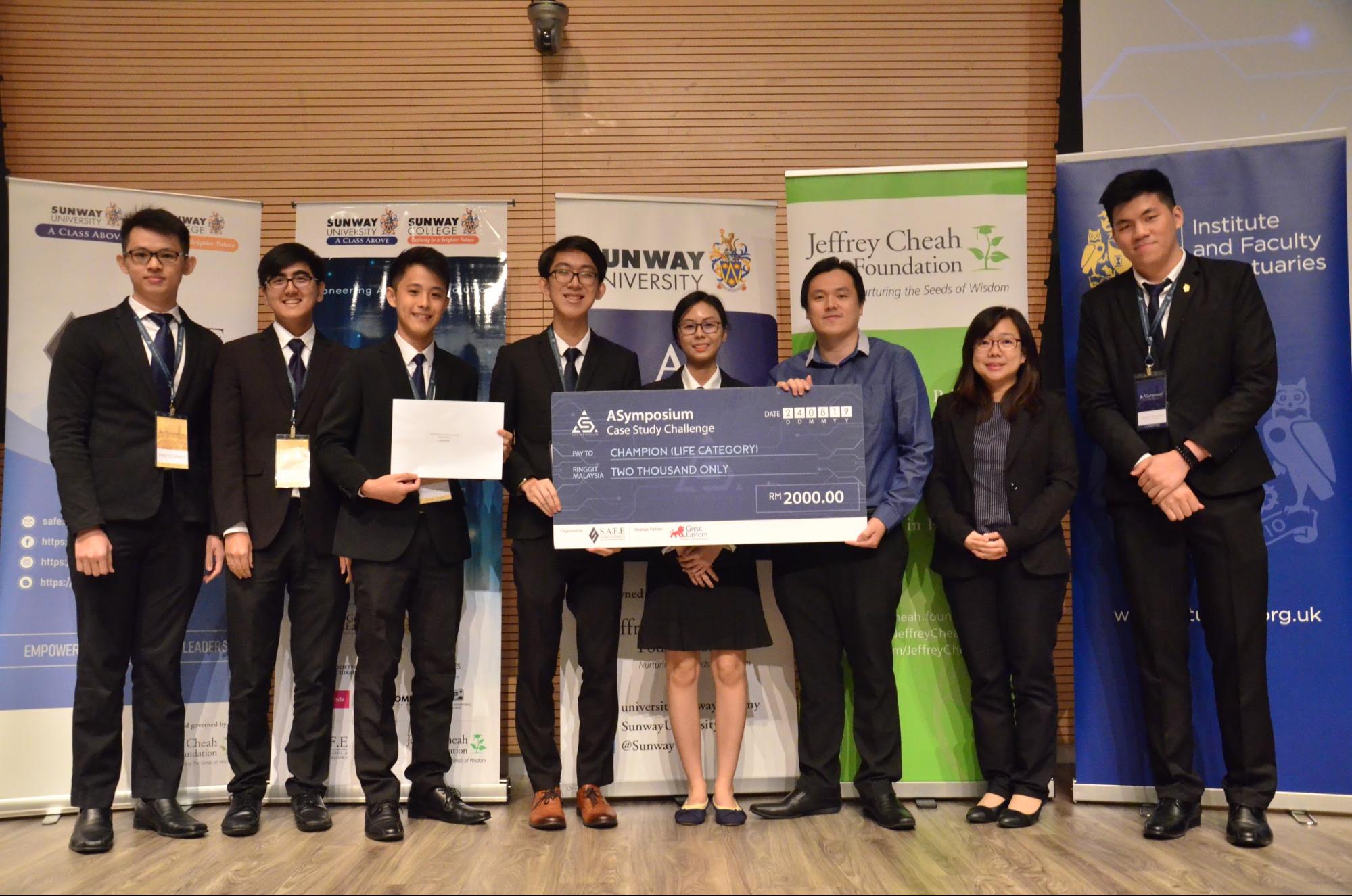

Following that was the exciting announcement of the winners of the case-study challenge! As for the life insurance case study, the winners were a Sunway team; Team ASperiment followed by a subsequent Sunway team; Team Imagination and the second-runner up was Team Angel of Death, also from Sunway. For the general insurance case study, Team Five guys from UTAR emerged as winners while Team ASAP from Sunway grabbed second place, followed by Team Renaissance from USCI in third.

All in all, ASymposium was very eventful and well-organised with a thoroughly planned out line-up and interesting topics relevant to undergraduate actuarial students. The panelists chosen had incredible chemistry and had a room full of students engaged throughout the 10 hours. Kudos to the Sunway Actuarial and Financial Excellence (SAFE) club for managing to host such a remarkable event! We look forward to more insightful conferences of similar standard in the near future.