Written by: Fajar binti Benjamin

Edited by: Gee Ren Chee

On Thursday, 13th of September, Sunway Property Economic Society (SUNPES) returned once again with an event aimed at enlightening participants on the pros of investment. This time, they brought in 3 speakers, each one specialising in a different field of investment: property, stocks and cryptocurrency.

The event started with an opening speech from the president, Miss Shaila as she touched upon how grateful she is for the good number of participants who decided to give up their Thursday evening to invest a little in their future.

At 6.15, the first speaker, Dr Daniele Gambero, an Italian expat living in Malaysia for over 20 years started his lecture titled “Property Investment: The Only Bad Time to Buy Properties Is.. Later”. Dr Daniele Gambero is both the CEO and co-founder of strategic marketing consultancy firm, REI Group of companies. He launched his book “Malaysian Propenomy” in 2016 where he explains his views on the Malaysian Property Market.

As a man in his 60s, he good-naturedly opened his talk with the words “I teach you about property, you teach me about millenials”. He proceeded to warn us how impossible it will soon be to buy properties in Malaysia, hence the title of his talk. The focus of his talk was both the benefits and the techniques of investing in properties in Malaysia.

Property investment not only requires very little leverage, it is also a 100% guaranteed appreciating asset. The Malaysian population is growing by around 450000 people yearly, yet in a year, only 160000 homes can be supplied. This paints a clear picture of the value of property, considering shelter is a basic human need. The initial property that a student could start out with need not be a mansion – even a basic low-cost apartment can bring about great returns.

He advised us to to make decisions based on reality, not perception, sharing this quote by Anais Nin with us: “We don’t see things as they are, we see them as we are”. We must personally make the effort to research the effects of different development projects in Malaysia on the value of the surrounding properties and not simply assume something is valuable from the surface of it. For example, the development of the MRT line greatly increased the value of certain properties in Damansara.

His parting words were to be cautious about which developers we choose to buy property from as there are many dishonest developers who happily take shortcuts on the safety and integrity of the buildings they develop.

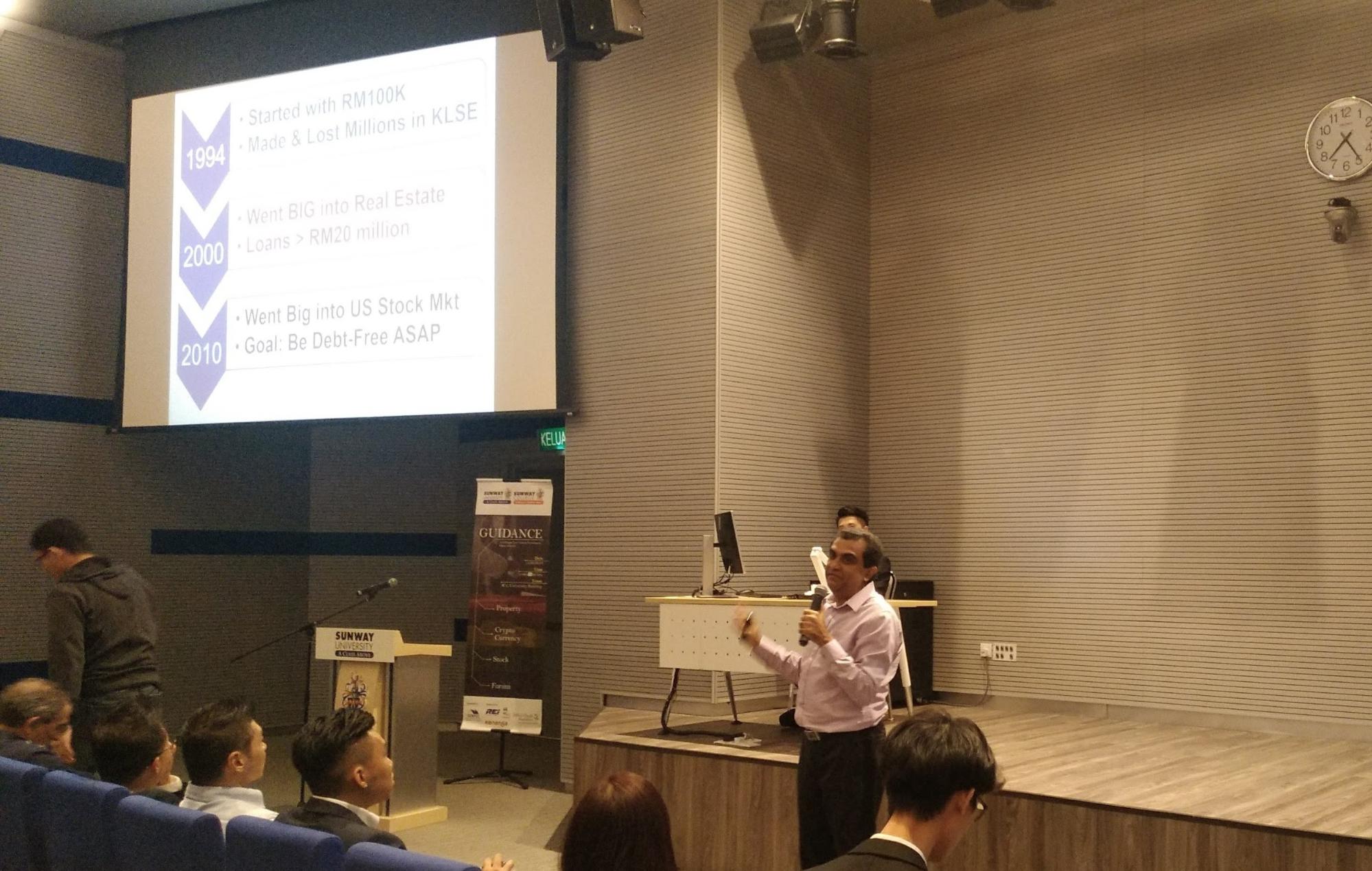

Next up was Mr Milan Doshi, a Singaporean who is the CEO and Founder of Doshi Consulting Solutions Inc which provides strategic, operational and organisational consulting and change management services to the financial services and clearing industry. He is also the best selling author of “How You Can Get Rich from the Property and Stock Markets”.

His talk was titled ‘How to Multiply Wealth through US stocks and ETF’. In his talk, he shared with us his 6 golden rules of life.

- Learn the right things from the right people

- Network with other more successful people

- Have unlimited earning potential

- Save as much as possible

- Borrow intelligently

- Invest wisely

“Why the US stock market and not Bursa Malaysia?” you might ask. Well, fun fact: we had 19 public holidays last year as opposed to US’s 12 and we lost RM1.5b per public holiday day. That is a lot of money to lose out on if you’re really trying to make a living out of your investments. Bursa Malaysia also does not have a trailing stop loss orders feature which means there is no way to protect yourself from losing large amounts of money overnight.

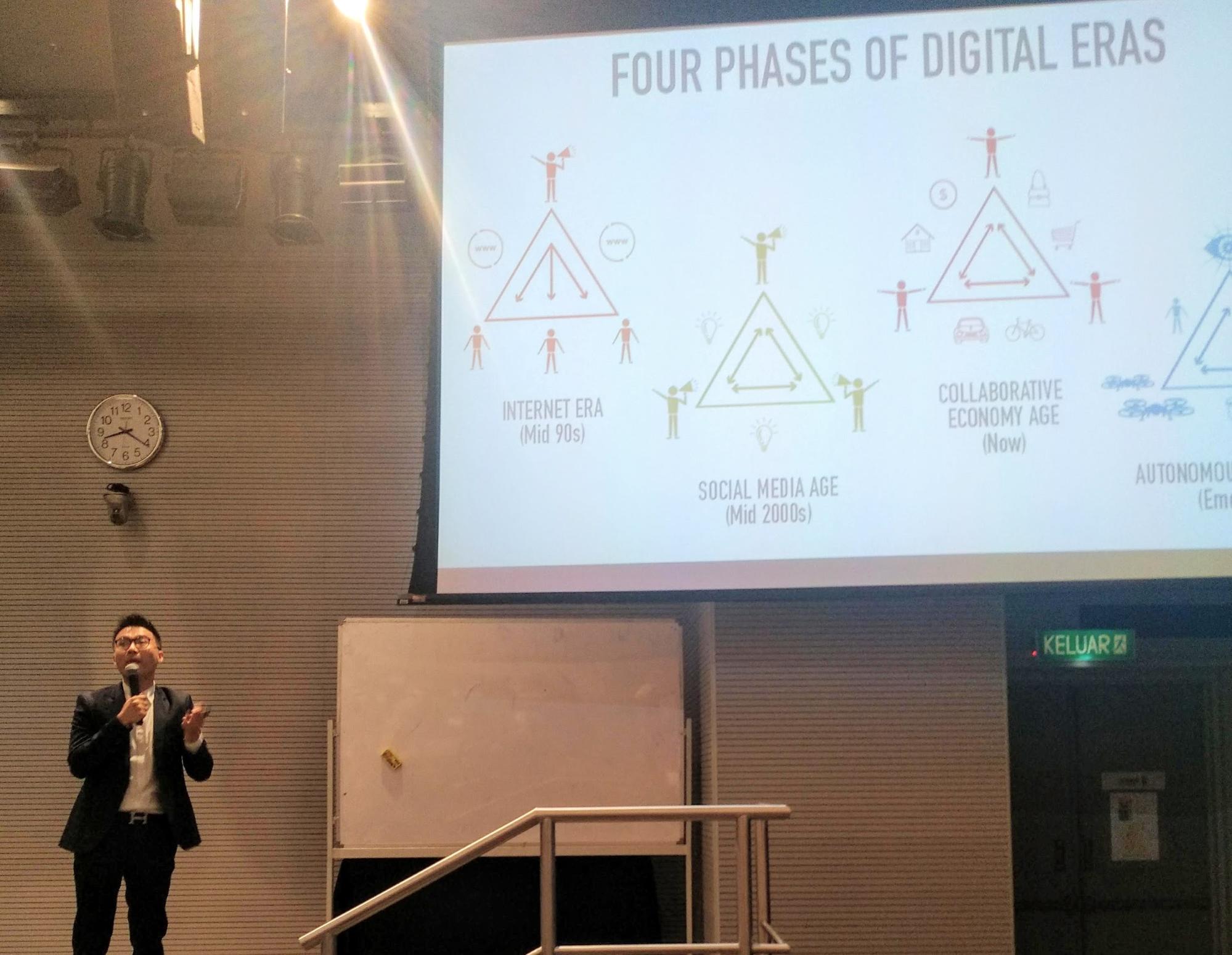

Last but not least, Mr Fabian Hoong, the self proclaimed “Blockchain Master” gave us a fast and loose talk on the benefits of understanding and investing in Blockchain technologies.

Whenever we talk about Blockchain, the first thing that comes to mind is the crazy hype around ‘Bitcoin’ that happened last year. Well, that bubble burst fast but that does not mean that cryptocurrency was just a fad that we can forget now. Blockchain is the technology of the future. It is perfectly set up to become the low cost and highly secure replacement for the system banks use at the moment.

Not only will blockchain take over banking, it’s estimated within ten years it will be completely normalised as a system used by all institutions, whether it be social media companies, engineering firms, schools or homeland security to carry information. Much the same way the internet and gadgets took over our lives seemingly overnight, blockchain is the next new thing sneaking up on us, and, those who are smart, will be looking for any way to cash in on it when it does.

After a short break, it was time for the forum. The panel very quickly agreed within the first few minutes that the stock market is the easiest to break into as the entry is very low, but that once sufficient funds had been collected, property market is the safest and most profitable bet.

Students enthusiastically questioned the panelists, asking for insider tips on which properties to pursue, which cryptocurrencies held the most value and what stock should they jump onto before it grows too expensive. Dr Daniele pointed us towards areas such as Penang and Kuantan for property investment but warned us to stay clear of Malacca and Kedah. Mr Milan Doshi showed us charts for the uptick in business for Facebook. Despite their many scandals, the company owns both Instagram and Whatsapp, all but guaranteeing its value will continue to grow. Mr Fabian Hoong reiterated that cryptocurrency isn’t where we should be looking, but instead, the technology behind it.

The Q&A session stretched on an extra 15 minutes as participants tried to milk every second of access to these experts for what they were worth. The event ended with a group photo, everyone sticking their thumbs up cheerfully. The event was both informative and interactive, a definite success for SUNPES.